Our human capital

Employees are a key part of our success as a company. Aegon’s success depends on maintaining a skilled, motivated, and purpose-led workforce. We seek to maintain high levels of employee engagement and wellbeing, and we foster a supportive and inclusive and diverse work environment. Employee engagement and wellbeing are assessed through regular employee surveys.

A diverse and engaged workforce

48%

Woman account for 48% of our workforce.

36%

Female representation among our senior management increased to 36% in 2022.

EUR 10.9 million

Invested in training and career development during 2022.

Engagement

Over 2022, our employee engagement increased by two points to 70%. This is driven by significant improvements in areas previously identified as drivers for engagement, one of which is leadership. Employees increasingly experience that leaders have a vision for the company and see leaders role-modeling the vision. As a result the outcome for “Leadership” increased by four points against the previous year to 61%.

The introduction of our purpose greatly contributed to providing employees with vision and perspective. At the start of the year, we introduced the new purpose to all employees via a company-wide virtual launch event. Our next step was to help our teams and country units around the world embed the purpose, along with our accompanying Best Life behaviors.

See more on our purpose page.

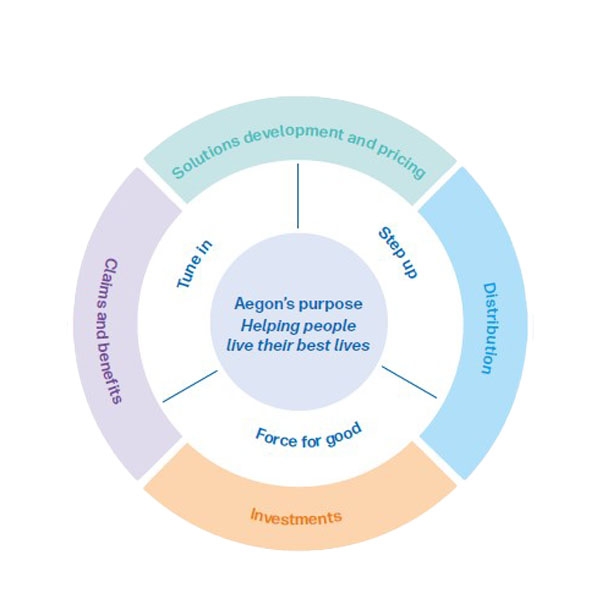

Our business model

We focus on creating long-term value for a broad range of stakeholders. Aegon seeks to support its customers with a broad mix of investment, protection, and retirement solutions, in addition to smooth and efficient customer experiences. As part of our wider responsibility to society, we promote financial awareness and good health and wellbeing among financial services users.

- Solutions development and pricing: Development of our financial solutions begins with our customers. We assess their needs and develop products and services to suit. We then estimate and price the risk involved for us as a provider;

- Distribution: our products and services are then branded and marketed, before being distributed via intermediaries that include brokers, banks, and financial advisors. We also sell to our customers directly;

- Investments: in exchange for products and services, customers pay fees or premiums. On certain pension, savings, and investment products, customers make deposits. We earn returns for our customers by investing this money;

- Claims and benefits: we pay out claims, benefits, and retirement plan withdrawals. We use the remaining to cover our expenses, support new investments, and deliver profits to our shareholders.

Tune in

We have touched the basics of our business model, purpose and vision. You can stay up-to-date by following Aegon on

Do you really want to impress your new colleagues with your in-depth Aegon knowledge? Here is some more ‘not so snackable content’:

- Scan through our 450 page annual report

- Listen to the 2,5 hour+ video recording of our last annual stakeholders meeting

Your first day