What does financial planning and the KonMari method have in common? More than meets the eye, as we will explain.

Marie Kondo, author of the best-selling book and hit Netflix show about tidying up has gained a cult following. The KonMari method, as it's known, has inspired self-described shop-a-holics and mini-hoarders to give up their possessions to make more space for a life with purpose and direction.

Aegon's purpose is to help people achieve a lifetime of financial security. Therefore, at a time when many people are not saving for retirement, let alone have a financial plan, Aegon wants to show that saving is just as easy as the KonMari method.

What is the KonMari method?

The basis of the KonMari method requires you to visualize the type of life you want and break down each part of that life (I wish to travel, learn a new skills etc.), by evaluating why you want that particular thing (to discover more about myself).

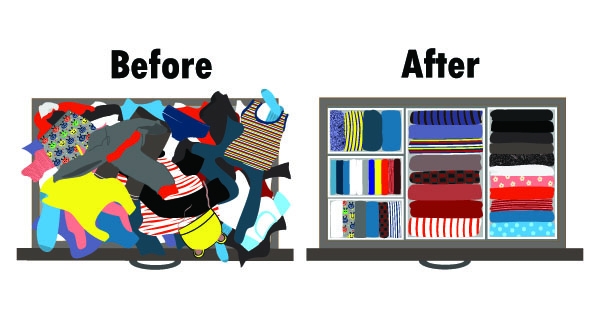

Based on your visualized future, you will then choose items that will help you fulfil those wishes. Going through categories (clothing, books and paper, miscellaneous) you'll be confronted by having to answer whether each item you are keeping "Sparks Joy". If it does, you keep it; if not, you discard it.

What does a Netflix show have to do with financial planning?

The KonMari method actually follows the same principles as planning for a successful financial future. Mike Mansfield, Program Director Aegon Center for Longevity and Retirement at Aegon, explains that financial planning is simple in theory, but like many things can become overwhelming in practice.

"Financial planning starts with proper planning, but it doesn't need to feel like a chore. Just like the KonMari method, you're planning for the future you want to have and are learning about yourself and what you find important in the process," explains Mansfield.

One of the first things he suggests is to think about what you want in the long and short term. What does the thought process around long term look like? The thought of planning for the future or a retirement that could be as long as 20 years can be a daunting task. It becomes easier if you break things down into categories and start setting manageable short, medium and long term savings goals for each category.

A short-term goal could be saving for the deposit on a starter home that you plan to live in while your family is growing up and then long-term to downsize and move to a house by the beach when you retire. As well as setting financial goals, it is also important to think about what you are going to do to maintain your good health so that you can enjoy the retirement you have worked so hard for.

"One of the hardest things for people to do is to admit what they want out of their life, and say it's ok to save money for it."

"Financial planning starts with proper planning, but it doesn't need to feel like a chore."

Mike Mansfield, Program Director Aegon Center for Longevity and Retirement at Aegon

Does it spark financial joy?

Once you've thought big about your future, it's time to put that down onto paper. "You'll need to examine your original list and decide what is realistic and a priority and what can be a longer term plan," Mansfield says.

Next comes the costs and a timeline. "Setting a cost to each future wish will help you prioritize what is really important for you and your family. By assigning a cost, you can also see pretty quickly how far you still need to go to save up for that dream vacation or quitting your job to pursue your hobby or side business full-time." This is basically the KonMari, does-this-spark-joy methodology.

If you're in a position where putting aside a vast sum of money each month isn't an option, then start with what you can handle, and build-up. It will help you get into the habit of saving and when you are able to put a bit more aside, it won't come as a shock.

Saving for the future, a work in progress

Have suggestions on how you motivate yourself to save instead of spend? Let us know