Aegon's UK business has published a unique study that for the first time assesses the role of behavior and mindset on financial wellbeing.

Financial wellbeing is a combination of being able to respond to financial unpredictability and making informed choices so we can do what makes us happy and give us a sense of purpose now, while also being able to plan for the future.

This is the universally relevant message of the unique Financial Wellbeing Index published by Aegon UK that assesses the role of mindset in financial wellbeing.

“What we’ve found is that for most people, the biggest improvement they could make to financial wellbeing is to reframe the way they think about money."

Steven Cameron, Pensions Director at Aegon

Common money problems

Entitled How to improve your financial wellbeing notes that healthy finances are a key component of financial wellbeing, but many people in the UK are struggling in this regard:

- 40% of the population have less than £100 left at the end of the month

- 29% of people do not have any emergency savings

- Just 10% of people pay more than the auto-enrolment minimum of 8% of qualifying earnings into their workplace pension

- 49% of people have some form of unsecured debt which averaged £5,700

- While there is a link between low incomes and money worries, more than half (55%) of average earners and more than 1 in 3 top earners say they worry about money

Mindset

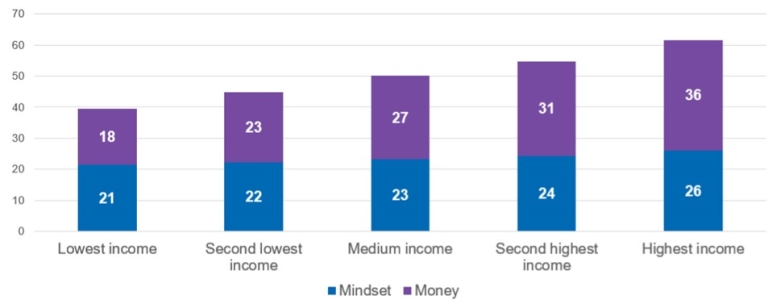

The study suggests that the biggest improvement most people could make to their financial wellbeing relates to mindset. Mindset scores were lower than money scores for all but one income group. The scores did not improve much the higher peoples’ incomes were.

Common mindset problems

Lower mindset scores were a result of a number of factors, including;

- 38% of people have only a vague idea of where they want to be financially in 10 years’ time versus 29% who have a specific idea

- 28% have only a vague sense of what gives them joy or purpose, which are key elements of happiness

- 87% of the population do not have a financial plan to achieve long-term goals

- 16% of the population frequently compare their finances to the finances of those better-off than them, with younger people far more likely to do so

- Only 17% of people were able to answer at least 4 out of 5 basic financial literacy questions correctly

Reframing thinking about money

Financial wellbeing is an increasingly 'hot' topic, but it's usually talked about in very narrow terms – money in the bank or levels of debt, says Steven Cameron, Pensions Director at Aegon's UK business.

'What we've found is that for most people, the biggest improvement they could make to financial wellbeing is to reframe the way they think about money. It's not always possible to make quick changes to your level of income or savings, but by thinking about what sort of future you’re working towards, and the steps you'll need to get there or by making more realistic social comparisons, you can make big strides towards a better relationship with your money."

Top tips to improve your financial wellbeing

The study offers a number of tips to help to adjust your mindset and improve your financial wellbeing.

Put happiness first

Be conscious of the things that give you sustained happiness – whether that be joy or purpose - and ensure that you are spending time, energy and money on those things, with your future happiness in mind.

Savvy social comparisons

If you’re making social comparisons, make them healthy and realistic, instead of comparing your finances to others whose financial lives appear better. Or use your past self as a comparison to measure how far you have come.

Picture your future self and lifestyle

Spend time regularly visualizing your future self and what you might be doing. Paying attention to the life we want to live - and our pension and investment goals to achieve that lifestyle - can keep us on track.

Make a long-term plan and write it down

People who write out a financial plan save more regularly and do better financially.

Hold your nerve in a crisis

When tempted to change your long-term investments, remember why you started saving, so you don’t panic and do anything you might regret, even if a financial crisis is looming.