Make your long-term finances worth celebrating by adding retirement planning to your New Year's resolutions. Aegon gets you started off with the five fundamentals for retirement readiness.

According to Aegon's latest research, only 29 percent of workers globally are very/extremely confident that they will be able to retire comfortably. Even fewer people (23 percent) globally are very/extremely confident that their healthcare will be affordable in retirement, according to Aegon's eighth annual Retirement Readiness Survey. Two in five people globally (41 percent) feel stressed about their long-term financial plans for retirement at least once per month.

Step-by-step

But when and how to get started on your financial planning? The when is easy: there is no better time than now and the dawning of the New Year is a perfect opportunity to start making profitable changes in your financial readiness. To help get you started, Aegon's report sets out Five Fundamentals for Retirement Readiness that define steps people can and should take to help ensure that they are on track for a comfortable retirement. They involve different aspects of saving, planning, and preparing for longer lives and older age.

1. Start saving early and regularly

The best route to retirement readiness is starting to save as early as possible and becoming a "habitual saver" who always saves for retirement. Only 39 percent say they are habitual savers.

2. Develop a written retirement strategy

Only 16 percent of people have a written plan for retirement. Fewer than half are currently factoring future healthcare expenses into their retirement savings needs.

3. Create a backup plan for unforeseen events

Unforeseen circumstances can have a catastrophic impact on your household finances. Globally, only 35 percent say they have a backup plan to provide income if they are unable to work before reaching retirement age. Have you given this some thought?

4. Adopt a healthy lifestyle

Living healthily can help you to stay fit for longer and avoid the costs associated with ill health. This includes regular exercise, healthy eating and avoiding smoking and excessive drinking.

5. Continue to learn

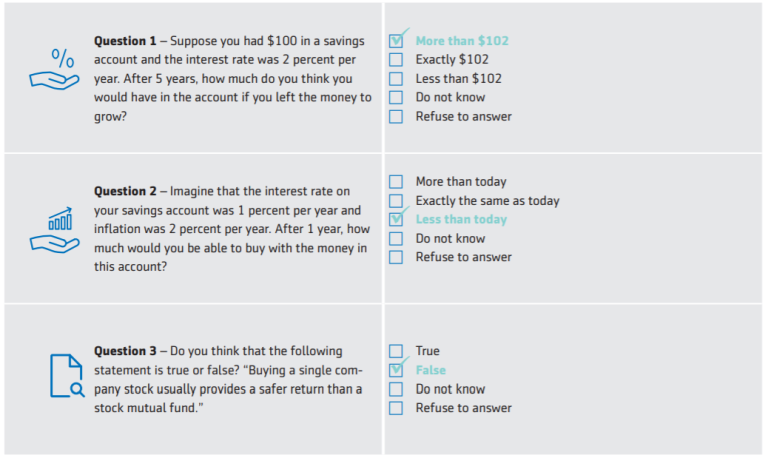

It is critical that you continue to learn and master new skills, to stay relevant in your job and continue to make informed choices for your retirement planning. Financial literacy is a compelling example of where improvement is needed. Aegon research found that only 30 percent of people globally can correctly answer all of the "Big Three" financial literacy questions developed by Drs. Annamaria Lusardi and Olivia Mitchell that test knowledge of compounding interest, inflation, and risk diversification. You can give this quiz a shot below!