The Dutch waited too long to design a truly individualized pension system, says Aegon CEO Alex Wynaendts. Germany, on the other hand, is in a good position to act at an earlier stage in the debate to avoid some of the mistakes made in the Netherlands.

Mr. Wynaendts emphasized the shared responsibility, encompassing individuals and pension providers, to help ensure adequate and ongoing pension coverage. Aegon's CEO was speaking during the recent Handelsblatt Insurance Summit in Munich.

Dutch system

Mr. Wynaendts expanded on these themes, using experiences of the Dutch pension system as a basis, in his presentation to the Summit:

The Netherlands is well known to have a solid pension system, largely as it is capital based. This system has given people real comfort for a simple reason: because it worked. And for decades, millions of people in the Netherlands therefore took financial security in retirement for granted.

Even today global consultancy firm Mercer ranks the Netherlands' pension system as the number 1 in the world, with Germany above average behind a cluster of countries such as Australia, Canada, Chile, the Scandinavian nations, Singapore and Switzerland.

"But it is an unfortunate economic fact and rule of life that 'good today', doesn't necessary mean 'good tomorrow'. People in the Netherlands were too late in realizing that their pension system also needed to be reviewed. In short, the pension reform debate started too late in the Netherlands," Mr. Wynaendts said.

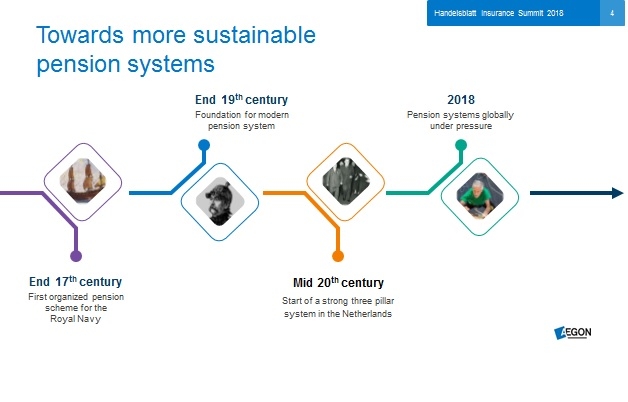

Origins

The basis for the current pension system originated not in the Netherlands, but in Germany when Chancellor Otto van Bismarck introduced Accident & Sickness Insurance for workers in the 1880s.

The familiar three-pillar system in the Netherlands was created in the 1950s by Dutch statesman Willem Drees, whose name will remain associated with the system he helped create.

The first pillar is a state pension for everyone, whether they were in work or not, original from the age of 65, although this has recently risen to 67. Employers provide the second pension pillar, while the third consists of contributions made by individuals to their own pension pot.

Times change

Many people in the Netherlands thought the current system could, and would, continue forever. One of the main reasons for this high level of confidence, Mr. Wynaendts said, was that the system is capital based. What does this mean? The majority of pension assets in the Netherlands are held in so-called company or sector 'Pensioenfondsen' – foundations and entities legally separated from the capital of employers and companies, in other words not on the companies' balance sheets.

The world has, however, changed significantly between the 1950s and today. And as a result, the Dutch retirement system is today under pressure.

Three main developments – which can be seen right across the world – are putting the Dutch system under pressure. These are ageing and demographics, particularly the deteriorating ratio between those who have a paid job and those living on their retirement income; persistently low interest rates; and risk sharing between generations.

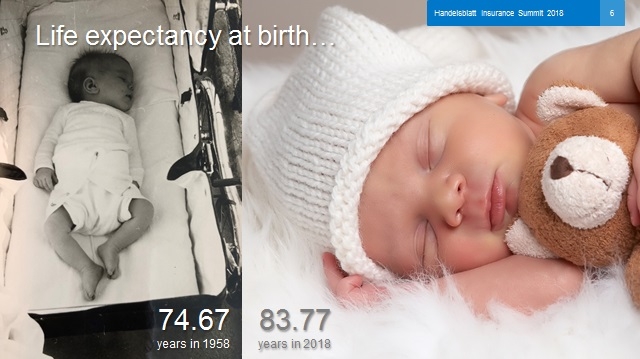

Life expectancy rising

Over the last 50 years, the life expectancy at birth for a Dutch person has increased by nearly a decade. This means that the average number of years in retirement for a woman in the Netherlands will have grown in the future from 9 years in 1958 to 16 years today. This impacts all pensions, whether they are capital based or not.

The challenge of financing increasingly long retirements is made even greater by the fact that the proportion of workers to retirees in the economy is changing rapidly, putting e.g. the Dutch state pension under pressure.

According to OECD figures there were 30 people age over 65 for every 100 people of working age.in the European Union in 2015. By 2050, that will have almost doubled, to 56 people. Indeed it is estimated that it will be even higher here in Germany, with 59 people aged over 65 for every 100 people of working age. The result of this this would be only two workers, instead of three, for every pensioner.

Low interest rates

Long-term interest rates have declined dramatically over the past 20 years, and despite a recent increase, it's not expected that they will return to the levels of 10 to 20 years ago, or for the foreseeable future at the very least.

The result is that guarantees are no longer affordable: pension funds are required to stop indexing or cut payments when coverage is too low. And, for insured pensions, this means that guarantees become too expensive for employers.

In an environment where states unable to provide the same level of social protection as in the past, and company pensions under pressure, there is an increasing shift in responsibility to individuals to save for their own retirement. This is aligned with societal changes of individualization that we see all over the world.

Labor markets have changed fundamentally. In the past many people stayed in the same company or sector for their entire working life. That is now the reality for only a small minority. Today's workers switch careers, change sectors and take career breaks. All of which makes it very difficult to share risk by saving in a workplace retirement scheme.

Persistently low interest rates, increased longevity and increased capital requirements have led to a shift away from guaranteed products — which are now extremely expensive for customers — to more asset management type of products.

Defined contribution

Defined contribution pension plans make up over 50 percent of current the company pension schemes provided by insurers in the Netherlands, and almost 100 percent of new schemes — making DC the new norm.

The fact that younger generations will have a defined contribution scheme instead of a guaranteed pension benefit, explains why they do not wish to pay for what they see as better pensions for older generations; older generations who also had the luxury, in their eyes, of retiring earlier.

The Dutch government recently intended to anticipate this resistance by abolishing the system of average premiums and introducing a premium that is tailored to the individual circumstances of the individual pension saver. This was to be an essential element of a new pension system.

However, the government did not succeed in reaching an agreement in November 2018 with the trade unions on a pension system without risk sharing between generations.

Next steps

Mr. Wynaendts told the Summit that recognizing the challenges and discussion was not enough. That was our problem in the Netherlands in the early 2000s, when discussions were non-committal and didn't lead to decisions.

Things now appear to be changing, with debates leading to action.

Since 2013, the state pension age has increased incrementally to 67 and 3 months for the year 2022 and from that moment on the retirement age will always be increased when life expectancy increases. In addition, more strict rules have been introduced to measure coverage ratios for pension funds.

The industry re-adjusts

The financial services industry has also acted, focusing on return and cost efficiency, consolidation and rationalization of the pension sector, and the switch from defined benefit to defined contribution.

Wynaendts said that the insurance sector has had to redefine its role as financial service provider. The shift from defined benefit (DB) to defined contribution (DC) means more freedom of choice, responsibility but also more risks for the participants. On the other hand, there is a chance of a better pension through good investment results.

For insurers such as Aegon, this means that they see it as their task to enable the participants to make the right choices.

Pension reforms started late, but the good news is that the conversation has now shifted, from unrealistic and non-committal in the early 2000s to realistic and committal today. And as a result things are beginning to change, Wynaendts told the Summit.

Mr. Wynaendts stressed that the financial industry had never had such an important responsibility towards its customers and towards wider society. Therefore, he said, the industry had to:

- Rationalize and to improve costs in order to provide financial security at an acceptable price

- Advise and educate people

- Convey the message that people need to act now in order to be able to have financial security in the future, and to retire with dignity

Mr. Wynaendts concluded: "I hope I also made clear today that we can no longer expect the young generations to pay for the pensions of older generations. The lesson we learned in the Netherlands is that we waited too long to design a truly individualized pension system. Germany, on the other hand, is in a good position to act at an earlier stage in the debate you have here and maybe avoid some of the mistakes we made.

"This is something I feel very strongly about, and I hope that it is a message that we as an industry can communicate with real passion and with persuasion."